Our The Wallace Insurance Agency Statements

The distinction is that it offers the plan proprietor far more flexibility in terms of their costs and money value. Whereas a term or entire life plan locks in your price, an universal policy enables you to pay what you have the ability to or wish to with each costs. It also enables you to adjust your survivor benefit during the policy, which can't be made with various other kinds of life insurance.

If you have dependents, such as kids, a spouse, or moms and dads you're taking care of and do not have substantial wealth it might be in your benefit to buy a policy even if you are fairly young. https://peatix.com/user/19854623/view. Must anything occur to you, you have the comfort to know that you'll leave your loved ones with the financial means to settle any kind of staying costs, cover the prices of a funeral, and have some cash left over for the future

The Wallace Insurance Agency - The Facts

Cyclists are optional modifications that you can make to your plan to increase your coverage and fit your requirements. If a plan proprietor requires funds to cover lasting care costs, this rider, when activated, will certainly give regular monthly repayments to cover those prices. This cyclist can forgo costs after that occasion so protection is not shed if the policy proprietor can not pay the month-to-month expenses of their plan.

Auto insurance coverage pays for covered losses after an accident or incident, securing against feasible financial loss. Depending upon your coverage, a policy can secure you and your guests. A lot of states need drivers to have auto insurance policy coverage.

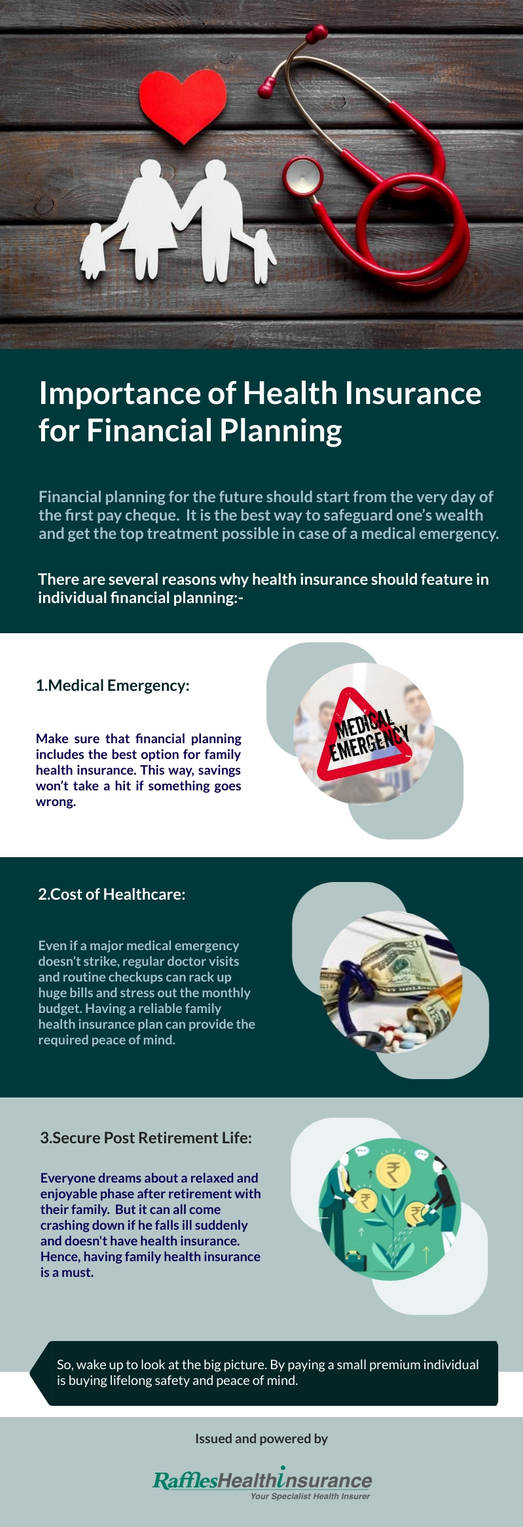

There are different sorts of insurance coverage items like life insurance policy strategies, term insurance, medical insurance, home insurance coverage and more. The core of any insurance coverage plan is to supply you with defense. Offering security and alleviating your danger is the basic intention of insurance policy. Making that tiny financial investment in any insurance go to this web-site policy strategies, will certainly allow you to be tension-free and offer protection beforehand.

3 Easy Facts About The Wallace Insurance Agency Explained

Along with the life cover, they likewise give maturation benefit, resulting in a fantastic cost savings corpus for the future. A valued ownership like your vehicle or bike additionally needs defense in the form of car insurance coverage in order to protect you from expense expenditures in the direction of it repairs or uneventful loss.

This is where a term insurance plan comes in useful. Protect the future of your household and acquire a term insurance plan that will certainly help your nominee or reliant obtain a lump sum or monthly payment to aid them deal with their monetary requirements.

Facts About The Wallace Insurance Agency Revealed

Protect your life with insurance coverage and guarantee that you live your life tension-free. Safeguard you and your household with the protection of your health and wellness insurance policy that will certainly supply for your medical care expenses.

Life insurance coverage strategies and term insurance policy policies are extremely crucial to safeguard the future of your household, in your lack. Life insurance coverage prepares assists in systematic cost savings by alloting funds in the form of costs every year.

Insurance urges savings by minimizing your expenditures in the lengthy run. Insurance supplies for an effective danger management in life.